To determine your accounts receivable turnover ratio, you would divide the net credit sales, $100,000 by the average accounts receivable, $25,000, and get four. If your small business lets customers set up credit accounts, good tracking habits and accounts receivable management help you keep your accounts receivable turnover ratio high and your cash flow stable. With 90-day terms, you can expect construction companies to have lower ratio numbers. If you’re in construction, you’ll want to research your industry’s average receivables turnover ratio and compare your company’s ratio based on those averages. Once you have calculated your company’s accounts receivable turnover ratio, it’s nearly time to use it to improve your business. But first, you need to understand what the number you calculated tells you.

Build Strong Customer Relationships

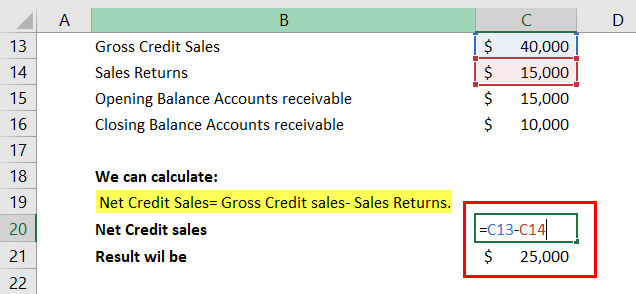

This investment comparison approach is not recommended for the comparison of companies operating in different industries. If you are an investor considering investing in a company, you should check its account receivable turnover ratio and look for a high ratio. Generally, a high ratio will be an indicator that the company has a good credit policy and good customer base, which means a high probability that your investments will be safe and hopefully start growing. To calculate net credit sales, subtract sales returns and sales allowances from all sales on credit.

How to use a Receivables Turnover Calculator

We know that to survive and thrive, businesses need financial flexibility to quickly respond to challenges and take advantage of opportunities, all in real time. Companies today need innovation guided by experience to unlock the potential of their assets to give better, faster access to the capital they require. In this example, the company has a low result indicating improvements to the company’s credit management processes are required.

Understanding Receivables Turnover Ratios

- The accounts receivable turnover ratio is an accounting calculation used to measure how effectively your business (or any business) uses customer credit and collects payments on the resulting debt.

- It’s recommended to calculate the accounts receivable turnover ratio on a regular basis, such as quarterly or annually, to monitor changes over time and identify any trends or issues.

- It most often means that your business is very efficient at collecting the money it’s owed.

- And more than half of them cite outstanding receivables as their biggest cash flow pain point.

You’re also likely not to encounter many obstacles when searching for investors or lenders. Lower turnover ratios indicate that your business collects on its invoices inefficiently and is cause for concern. That’s because it may be due to an inadequate collection process, bad credit policies, or customers that are not financially viable or creditworthy.

This figure should include your total credit sales, minus any returns or allowances. You should be able to find your net credit sales number on your annual income statement or on your balance sheet (as shown below). The receivable turnover ratio is used to measure the financial performance and efficiency of accounts receivables management.

Why You Can Trust Finance Strategists

These customers may then do business with competitors who can offer and extend them the credit they need. If a company loses clients or suffers slow growth, it may be better off loosening its credit policy to improve sales, even though it might lead to a lower accounts receivable turnover ratio. It’s cake decorator job description recommended to calculate the accounts receivable turnover ratio on a regular basis, such as quarterly or annually, to monitor changes over time and identify any trends or issues. Regular evaluation allows companies to take timely actions to improve their cash flow and credit management processes.

These professionals can help you manage your planning, policies, and answer any questions you have, about accounts receivable turnover, or otherwise. In this guide, therefore, we’ll break down the accounts receivable turnover ratio, discussing what it is, how to calculate it, and what it can mean for your business. Now that you understand what an accounts receivable turnover ratio is and how to calculate it, let’s take a look at an example. Therefore, it takes this business’s customers an average of 11.5 days to pay their bills.

It’s important for a company to investigate the underlying causes and take appropriate actions to address the issue. If the turnover is high it indicates a combination of a conservative credit policy and an aggressive collections process, as well a lot of high-quality customers. A company should consider collecting on excessively old account receivable that are tying up capital, if their turnover ratio low. Low turnover is likely caused by lax credit policies, an inadequate collections process and/or a customer base with financial difficulties. This being said, in order to best monitor your business finances, accounting, and bookkeeping, we’d recommend investing in robust accounting software, like QuickBooks, for example.

For example, you may allow a longer period of time for clients to pay or not enforce late fees once your deadline to pay has passed. Analyzing the A/R turnover should include industry benchmarks to give you a full understanding of whether the company is doing fine at an industry level. Another example is to compare a single company’s accounts receivable turnover ratio over time. A company may track its accounts receivable turnover ratio every 30 days or at the end of each quarter. In this manner, a company can better understand how its collection plan is faring and whether it is improving in its collections. The Accounts Receivable Turnover Ratio is a financial metric used to evaluate how efficiently a company is collecting payments owed by its customers.

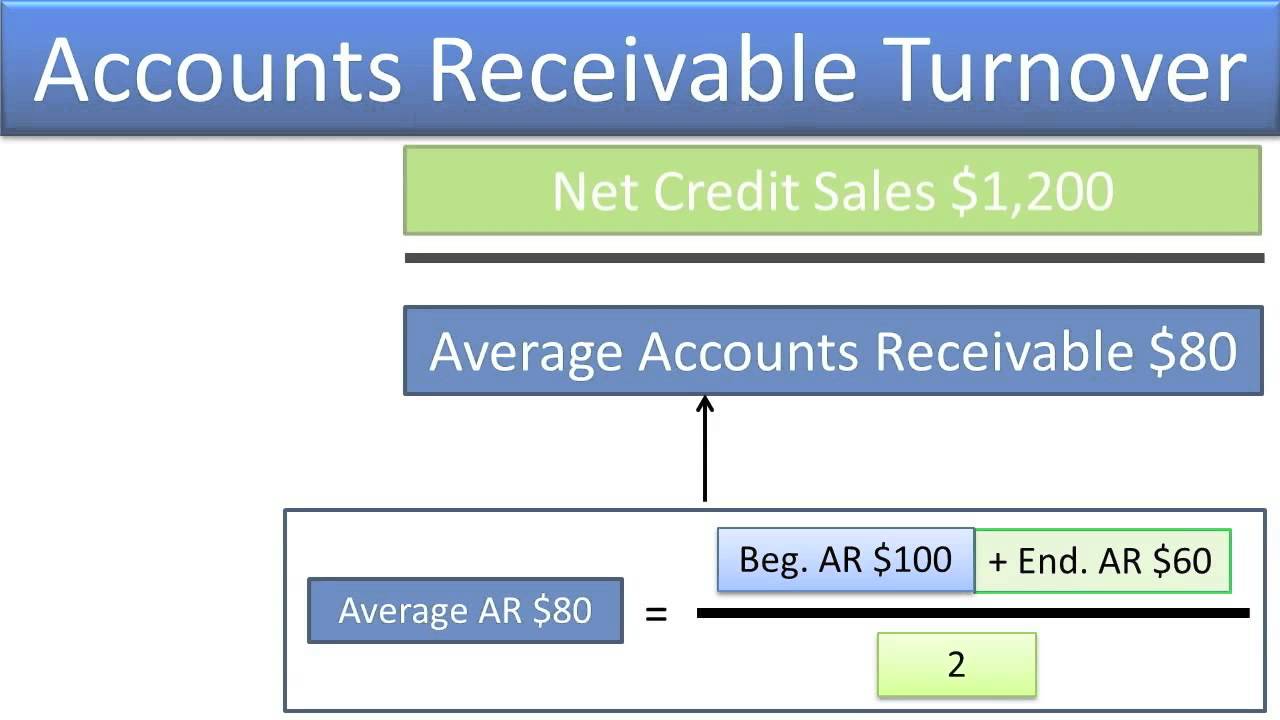

Once you have these two values, you’ll be able to use the accounts receivable turnover ratio formula. You’ll divide your net credit sales by your average accounts receivable to calculate your accounts receivable turnover ratio, or rate. The accounts receivable turnover ratio is an accounting calculation used to measure how effectively your business (or any business) uses customer credit and collects payments on the resulting debt. If Alpha Lumber’s turnover ratio is high, it may be cause for celebration, but don’t stop there.

If you own one of these businesses, your idea of “high” or “low” ratios will be vastly different from that of the construction business owner. Learn how to build, read, and use financial statements for your business so you can make more informed decisions. If you’re using QuickBooks, you can check out our guide on how to generate an income statement in QuickBooks Online in a few minutes. To learn more about the platform, our review of QuickBooks Online outlines all of its features that are helpful to small business owners. As such, the beginning and ending values selected when calculating the average accounts receivable should be carefully chosen to accurately reflect the company’s performance. Investors could take an average of accounts receivable from each month during a 12-month period to help smooth out any seasonal gaps.